Wednesday 5th March 2014 – Pre Market Note

2 min read

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_2″ last=”no”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

ADP Unemployment @ 8.15am ET

-

ISM @ 10am ET

-

Oil Inventories @ 10.30am ET

[/fusion_checklist]

[/fusion_builder_column]

[fusion_builder_column type=”1_2″ last=”yes”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Beige book @ 2pm ET

-

Stock traders watchlist: DANG, CSIQ, SWHC, TSLA

-

“Headline Risk” warning

[/fusion_checklist]

[/fusion_builder_column]

Ukraine has cooled off somewhat, probably due to frantic behind door negotiations. Media as usual will be told when it suits. As such, headline risk is still very much present. In fact the longer we go without a real headline the more likely the next one will be market moving, so caution is advised.

We have a raft of data today, including the ADP Jobs report at 8:15am ET. This is the non farm payroll warm up number so will likely be in focus. Then at 10am it’s ISM, another medium weight release, 10.30 it’s inventories for Crude traders then 2pm is Beige book.

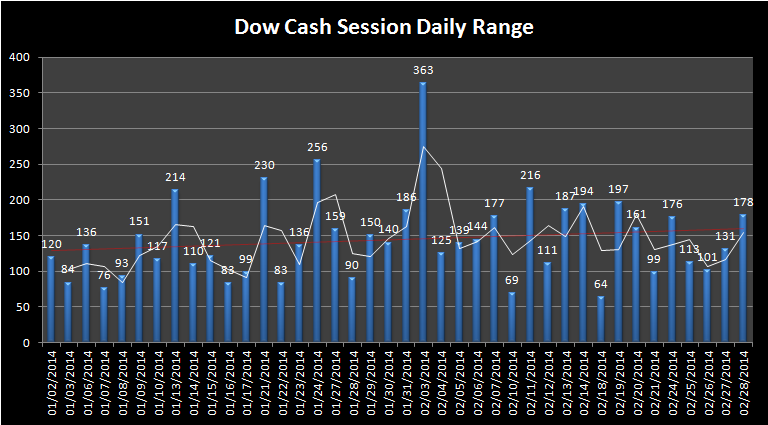

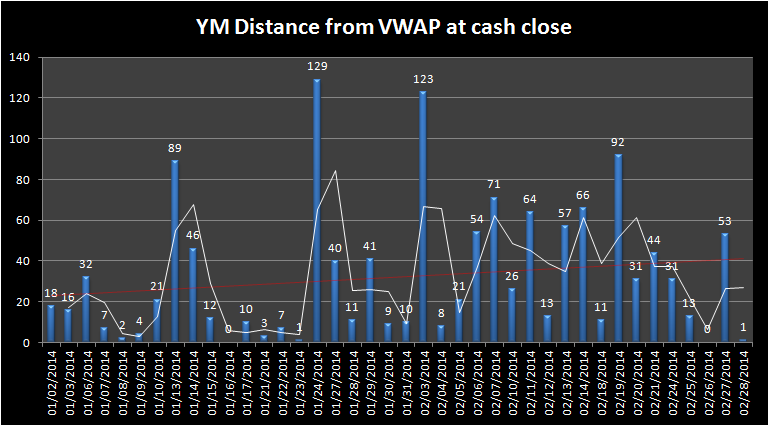

Yesterdays range was a very low 94 ticks on the YM and 12.5 handles on the ES, that was the 9th lowest of the year so far, well below the expected as traders digested the Russian news and waited for more clarity. We have left an island of price behind us on the daily chart and the YM is now within striking range of all time highs.

This morning’s DAX range has been a very low 57.5pts so far running at lower that usual volume. Aside from GBP which is making a small move as I type the other major FX pairs haven’t done much, nor have Gold, Crude or Bonds.

It’s a waiting game, the undertone in equities is Bullish but we all wait to see how this Russia V Ukraine story plays out.

Good trading,

[fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_separator top=”40″ style=”shadow”/]

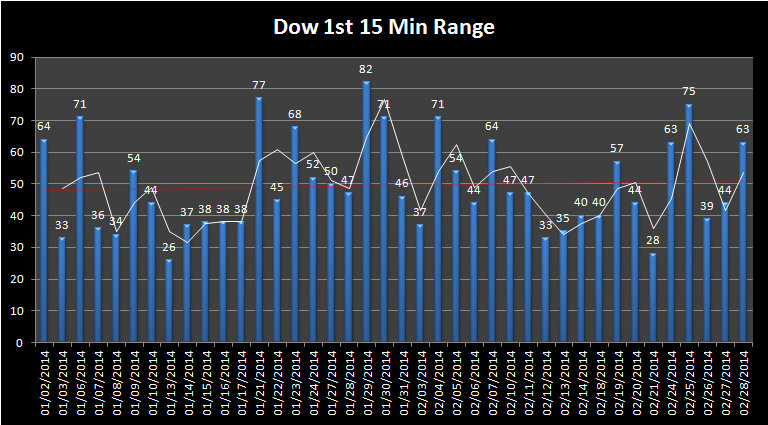

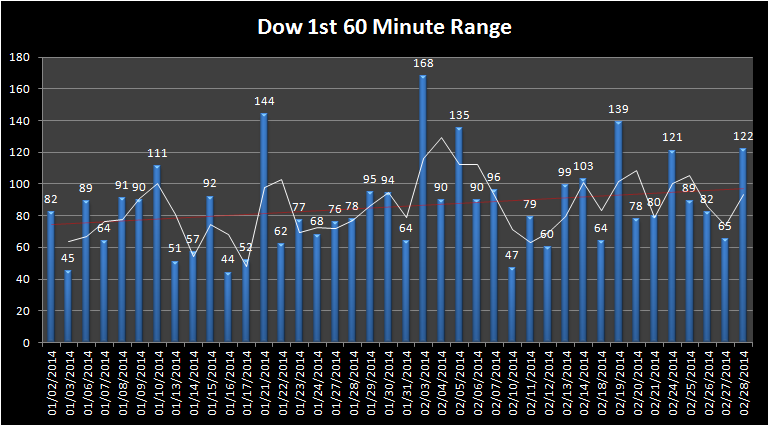

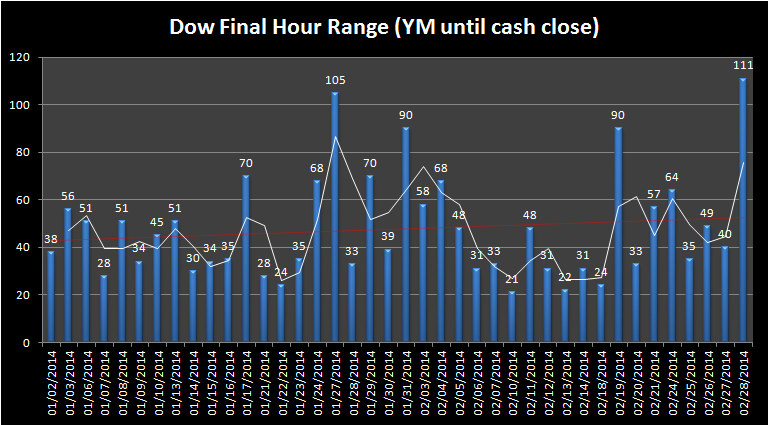

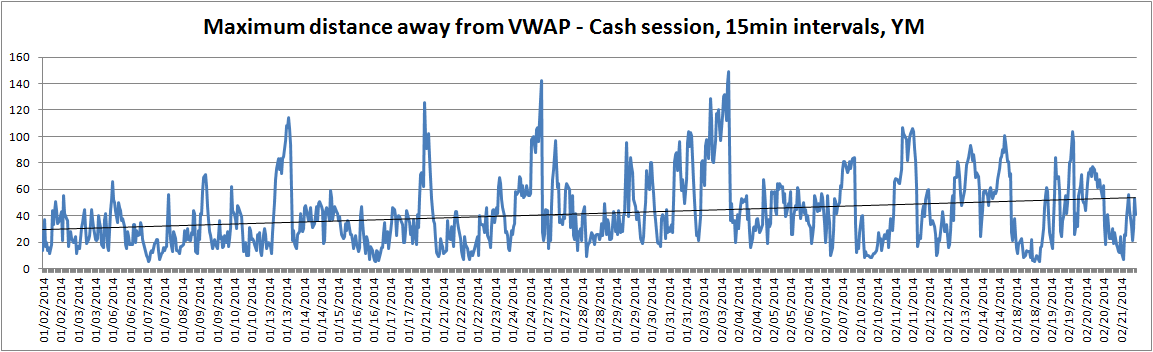

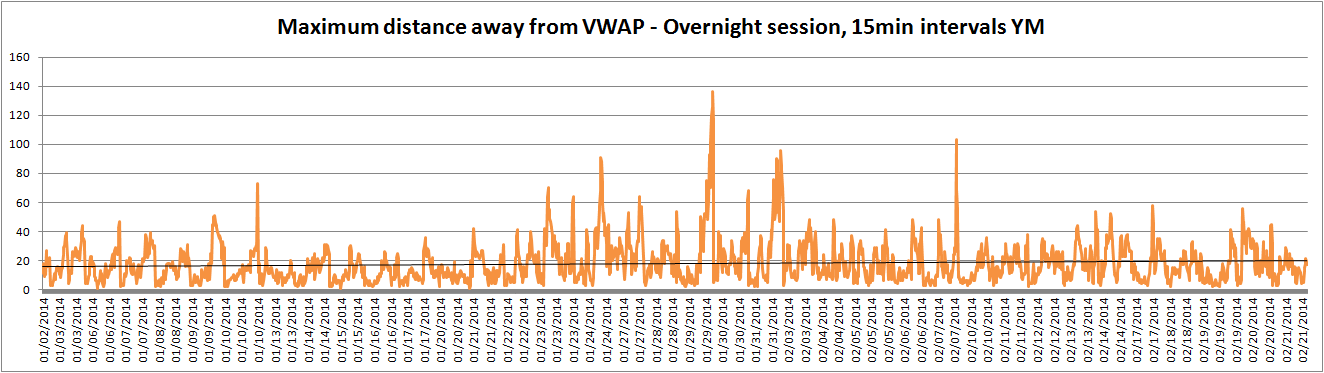

Market Ranges – Data taken from first trading day of 2014 to 2nd March 2014, updated each Monday

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]