Selling Puts Strategy That Generates Easy Monthly Income

3 min read

It’s called Selling Puts. And it’s one of the safest, easiest ways to earn big income.

Once folks discover this simple income strategy, they never look back. Because it’s just like Covered Calls, but WITHOUT the big capital requirements.

Today, you’re going to see the ideal setup for selling puts using my #1 put trading strategy that generates easy monthly income.

Before I get started, I wanted to remind you that I’m focusing this week and next entirely on put-selling. I think we’re in the middle of an interesting time in the markets – and it’s time to look at the basic strategies that can work in good markets and bad.

As always, you should never sell puts on something you wouldn’t want to own…

Remember: Selling puts obligates you to buy shares of a stock or ETF at your chosen short strike if the put option is assigned.

And sometimes the best place to look to sell puts is on an asset that’s near long-term lows.

The rationale is this: If something at 52-week lows falls further, you’d be fine owning it at even lower prices. If not, you simply enjoy the easy income.

And there’s an added benefit: When an asset is selling near long-term lows, it will typically have higher implied volatility, which acts like an added boost to the price of the put.

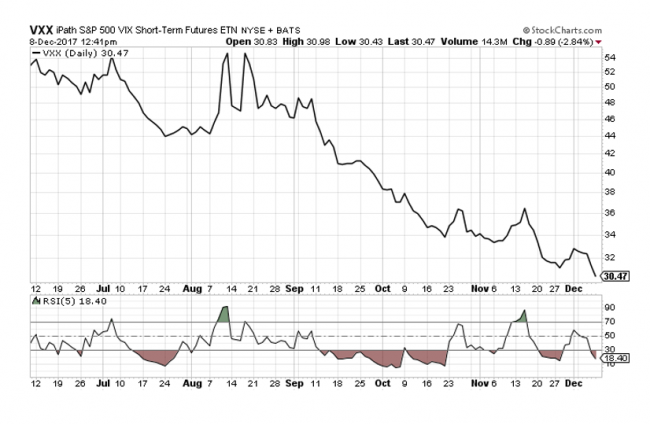

Case in point: I was sifting through my charts today and discovered an interesting opportunity in the iPath S&P 500 Short-Term Futures (NYSE: VXX). If you look at the chart below, you’ll notice that VXX is currently oversold on a short-term basis.

As an options trader, particularly one that prefers to sell options, this is the type of setup that I look for in a trade. The RSI (5) means that there’s a good chance that a mean-reversion move or reprieve is right around the corner. As a result, I want to sell a few puts on the volatility ETF.

An Exercise in Selling Puts

Selling a put obligates you to buy shares of a stock or ETF at your chosen short strike if the put option is assigned.

For example, let’s say you wanted to make a quick trade in VXX.

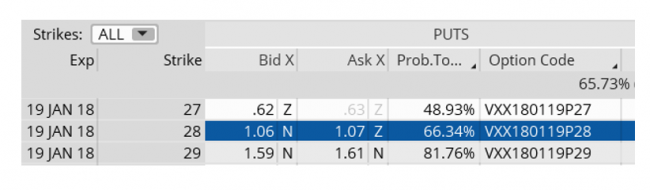

By selling the January 28 puts you can bring in approximately $1.06, or $106 per contract.

Selling the January 28 put requires you to have $2,800 of cash in your trading account.

If not cash-secured, selling puts only require 20% of the $2,800 or $560, but retirement accounts and certain brokers require the puts to be cash-secured. And in this case, that would be the $2,800.

The cash-secured return on the trade is 3.8% in roughly 42 days, or 38% annually.

This lines up exactly with my goal of bringing in between 2% and 4% selling puts each month.

And if the puts were not cash-secured, the return would be significantly higher.

If the stock closes at January expiration above $28, we keep the $106 and often repeat the process by selling more puts, maybe at the 28 strike or possibly at a different strike price. It truly depends on where the stock is trading at the time we sell the puts and how much premium we wish to bring in.

If the stock trades for less than $28 at January expiration, we are assigned the ETF for $28 per contract or $2,800 (100 shares per put contract sold). Often when this occurs I will begin to sell covered calls on the stock so there is an ongoing source of income coming in.

Right now, this Selling Puts strategy is crushing the market. With 85.6% annualized gains, this is my #1 trading strategy.