Pre Market Note

2 min read

Friday 14th March 2014

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_2″ last=”no”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

PPI @ 8.30am ET

-

Consumer Sentiment @ 9.55am ET

-

Crimea referendum at the weekend

[/fusion_checklist]

[/fusion_builder_column]

[fusion_builder_column type=”1_2″ last=”yes”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Nikkei – 3.3%

-

Stock traders watchlist: VXX, GLD, RSX, PLUG, X

-

Gold, USDJPY in focus

[/fusion_checklist]

[/fusion_builder_column]

Today is all about:

1) Data – anything unexpected will move the markets

2) Traders perception of weekend risk – The Crimea referendum is scheduled for Sunday. Most countries are not recognicsing it’s legitimacy and the US is set to impose sanctions immediately after. Russian troops are built up on the border and Ukraine has asked the US for military assistance which the US has refused “for now”

3) Yesterday’s action – It was a blood bath for bulls so it’s either day one of a multi day sell off or a bulls bargain opportunity. Given point 2) above I suspect it’s the former for now but we will see and know more at the open.

The day after a trend day is usually rotational as the market digests the move. Statistically we usually test the prior days extreme at least once, but as I type it looks as if the YM is already trading under Y low and the ES not too far. The market keeps getting tested like this and although it seems bad on the day of selling, the daily charts haven’t sustained too much damage yet.

It’s when you see 2-3 red days that the sentiment really starts to look bad. So today and Monday are crucial.

Good trading,

[fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_separator top=”40″ style=”shadow”/]

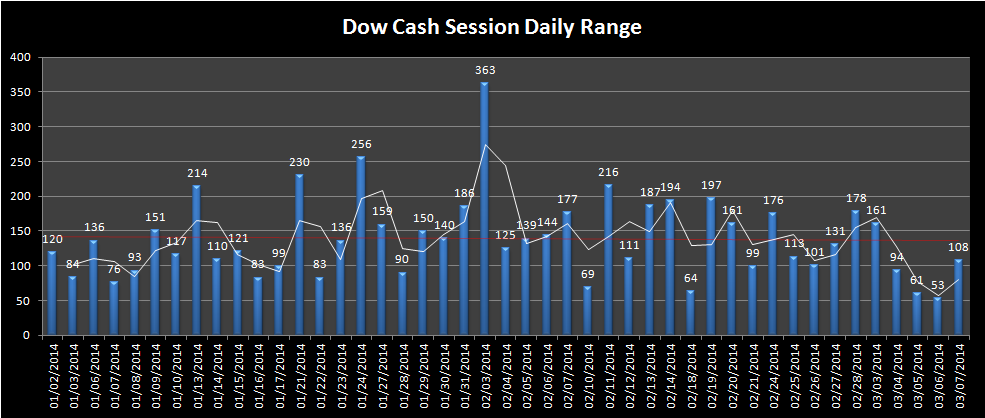

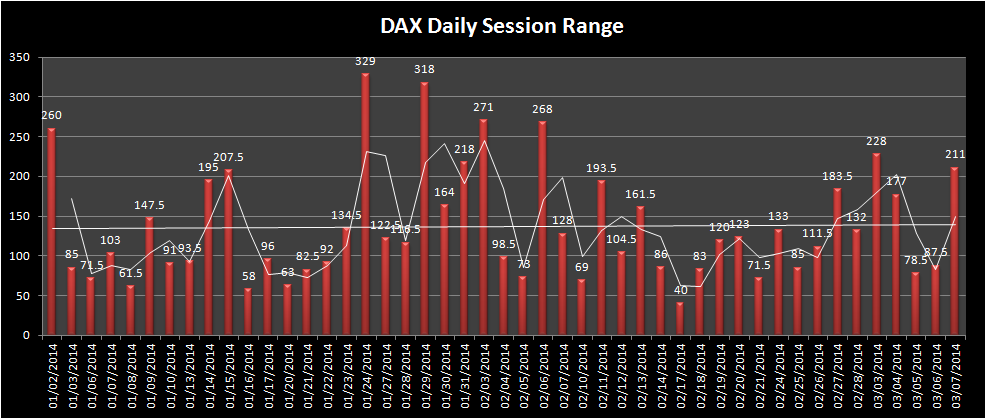

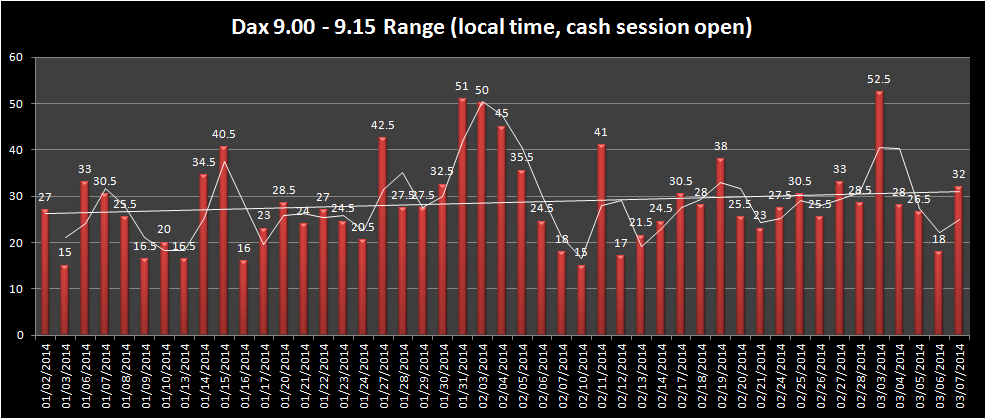

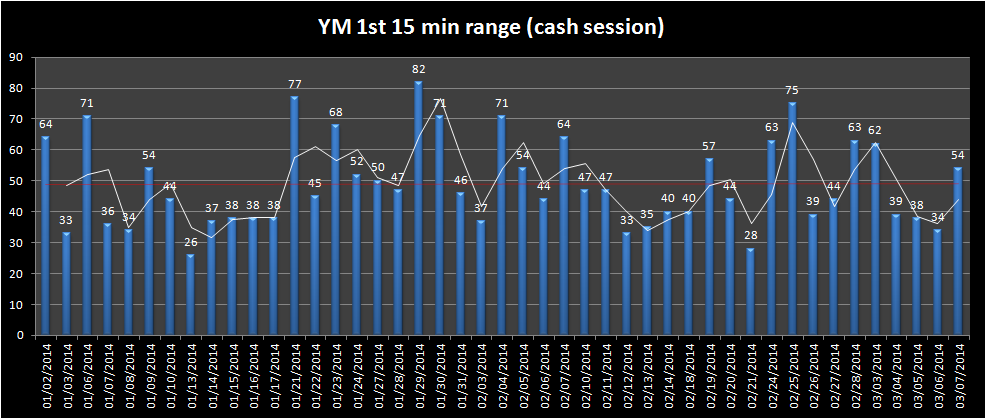

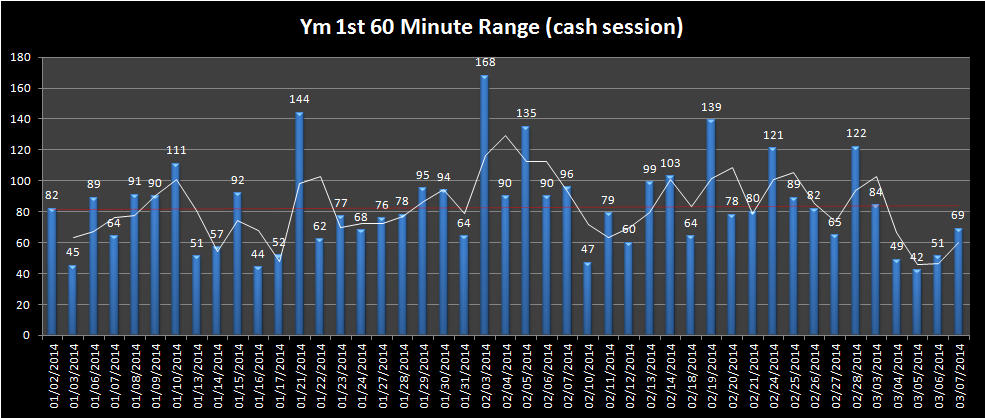

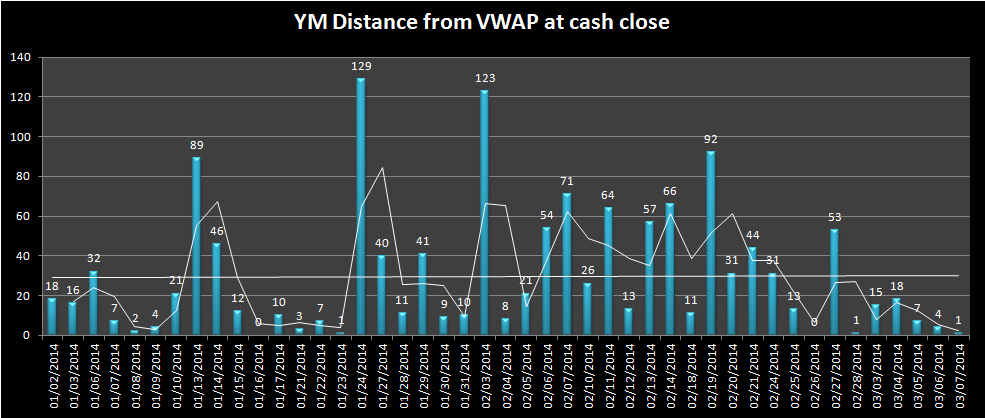

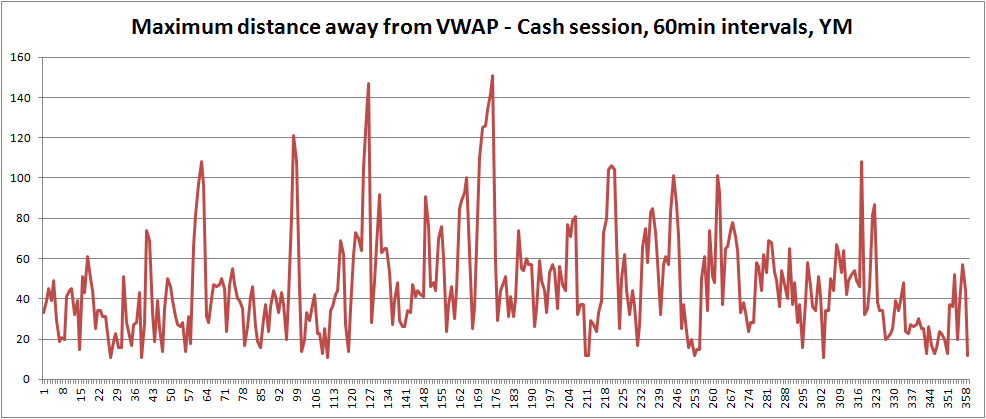

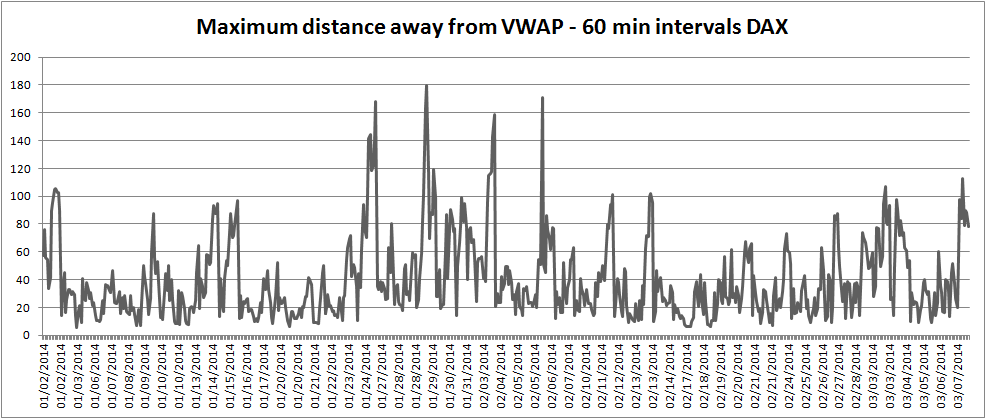

Market Ranges – Data taken from first trading day of 2014 to 7th March 2014, updated each Monday

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]