Pre Market Note

2 min read

Thursday 13th March 2014

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_2″ last=”no”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Jobless Claims @ 8.30am ET

-

Retail Sales/Import Export Prices @ 8.30am ET

-

Business Inventories @ 10am ET/ NatGas @ 10.30am ET

[/fusion_checklist]

[/fusion_builder_column]

[fusion_builder_column type=”1_2″ last=”yes”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Watch the futures rollover today – March to June

-

Stock traders watchlist: PLUG, HLF, DG, KKD

-

Bad data out of China last night

[/fusion_checklist]

[/fusion_builder_column]

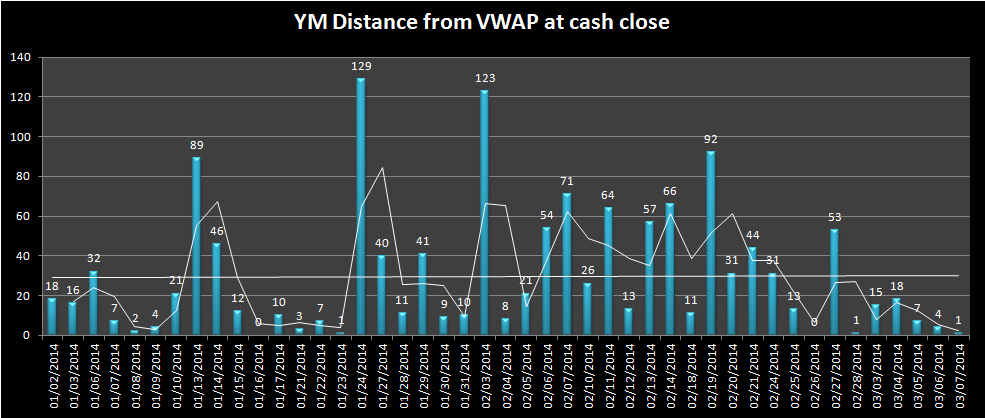

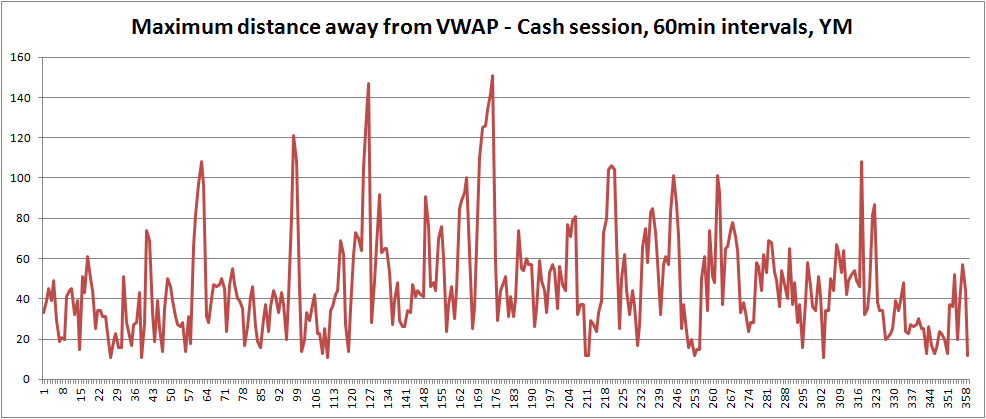

Just when you think markets have had all the range bound trade they can take and are ready to make a break for it, the VWAP magnet gets fired up, and all those that were trapped ready to provide breakout fuel get a reprieve.

The market needs a catalyst to get going and bring the higher time frame participants into the ring. I suspect that will be Ukraine news but it could equally be an economic release that’s outside of the expected range. We’ve got a decent batch of data today for the first time this week starting at 8.30am ET with retail sales.

If you’re trading the US futures remember today is rollover day where traders start to shift over to the June contract (M) from March(H). There’s still more volume in March at the moment but it will move to June towards the afternoon.

China had another batch of pretty weak data overnight, although the US futures don’t seem too concerned so far. Perhaps waiting for domestic data.

Again the Ukraine news is still quiet but remains a significant headline risk.

Good trading,

[fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_separator top=”40″ style=”shadow”/]

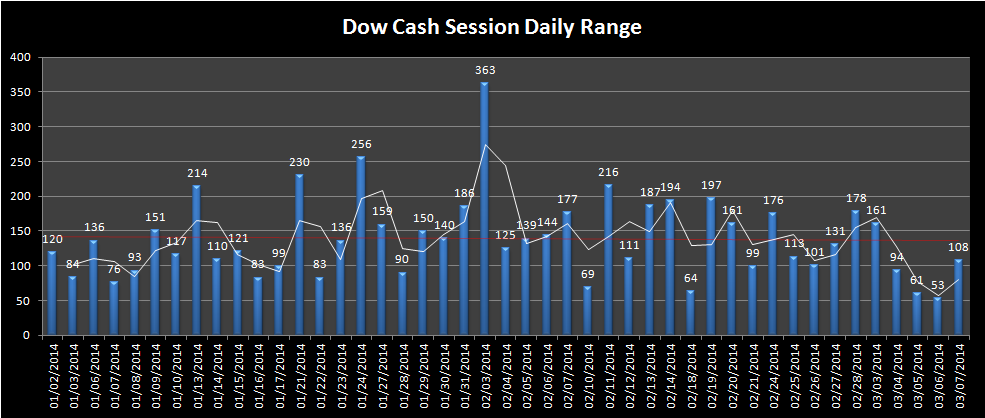

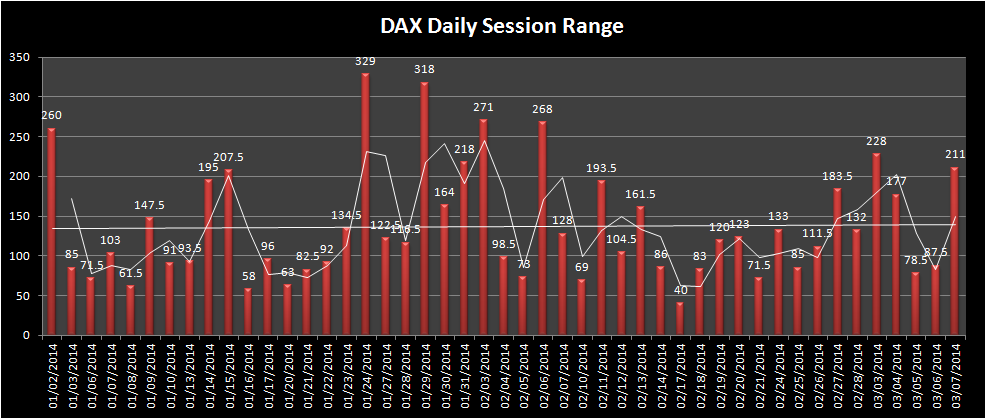

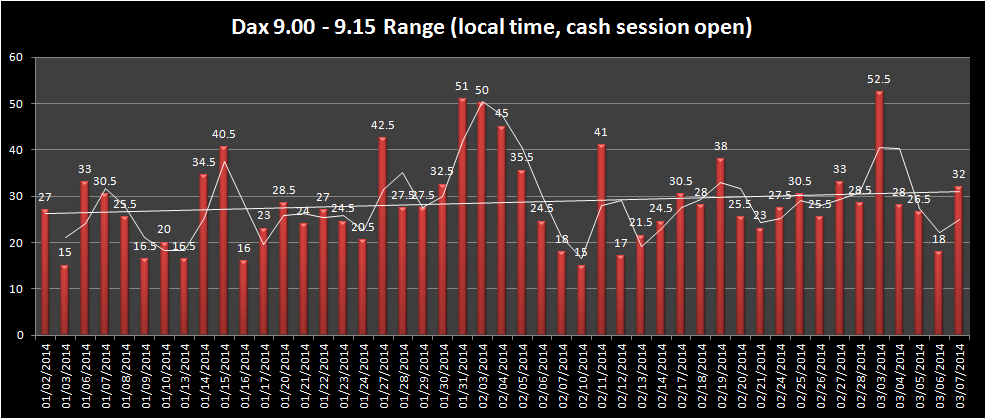

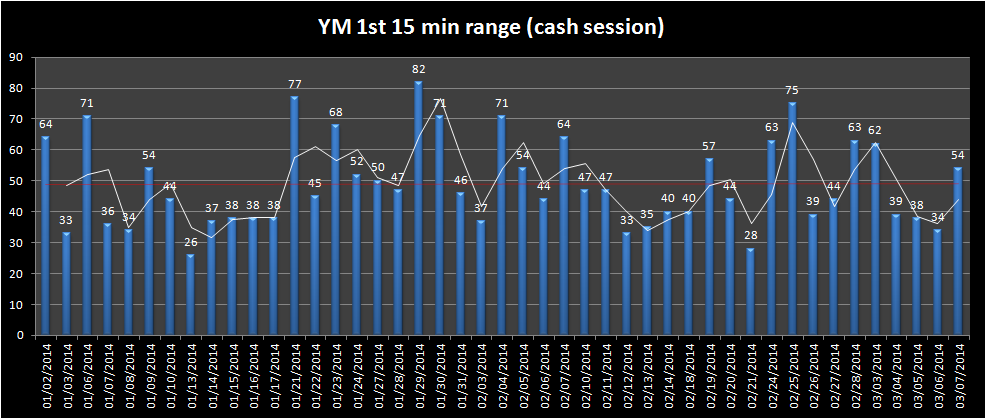

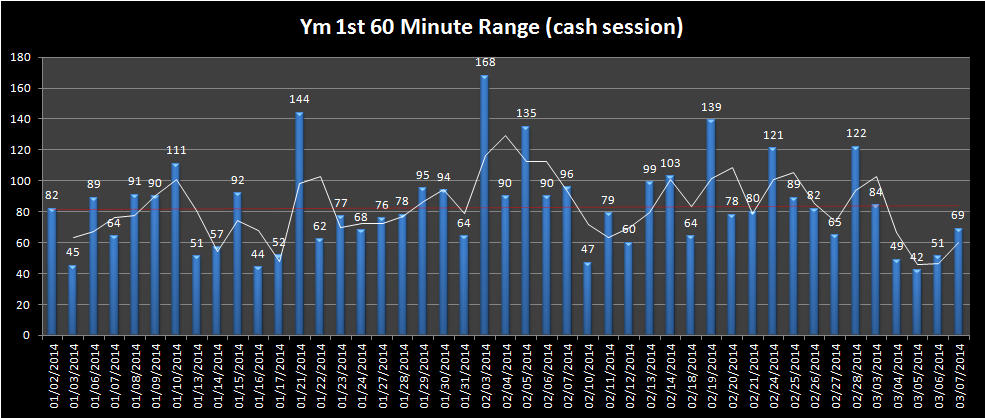

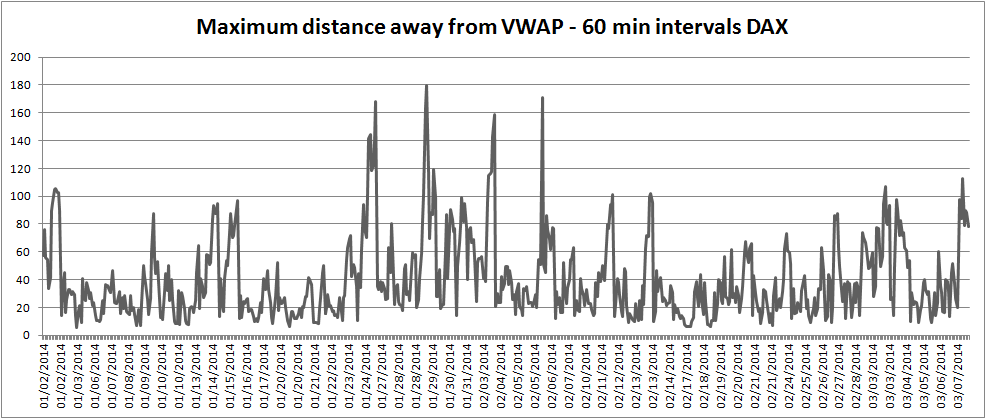

Market Ranges – Data taken from first trading day of 2014 to 7th March 2014, updated each Monday

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]