Pre Market Note

2 min read

Tuesday 11th March 2014 – Pre Market Note

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_2″ last=”no”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

JOLTS @ 10am ET

-

Wholesale Trade @ 10am ET

-

Most markets quiet

[/fusion_checklist]

[/fusion_builder_column]

[fusion_builder_column type=”1_2″ last=”yes”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Food based commodities on a tear

-

Stock traders watchlist: TSLA, P, YELP, PLUG, DANG

-

Ukraine newsflow eerily quiet

[/fusion_checklist]

[/fusion_builder_column]

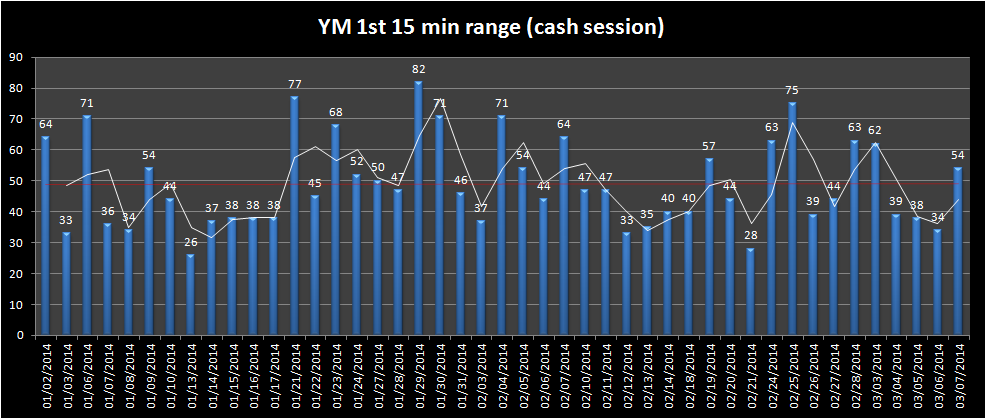

It’s all quiet out there for now, as I type the YM’s overnight range is a whopping 38 ticks…….and so we wait. Major FX pairs are equally dull, the only things that are moving are food based commodities. In fact Lean Hogs (yes I said lean hogs!) went limit up yesterday, that’s several limit up moves in the space of a few weeks. Coffee too is still ripping to highs. I can’t say that lean hogs is a market I favour to actively trade but as part of the bigger picture theme, higher food prices don’t help consuming economies.

There are still a handful of stocks that are reasonably active. PLUG power has become very volatile with good liquidity and volume. The momentum stock basket mostly took a hit yesterday so I’ll also be watching the likes of Pandora, Tesla and Yelp today.

Meanwhile we all wait for news from Ukraine. What is going on behind closed doors? The US is frantically trying to sort this out diplomatically and Putin has dug his heels in.

So far we’ve only seen bursts of local news, ie shots fired or trucks being driven into gates. Not exactly ES moving headlines. But interestingly even these meaningless rumours get spread very quickly. You can be sure when ‘real’ Crimea news hits the wires, the markets will react swiftly.

Good trading,

Morning Audio Briefing @ 9.00AM ET/ 2.00PM GMT

[fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_separator top=”40″ style=”shadow”/]

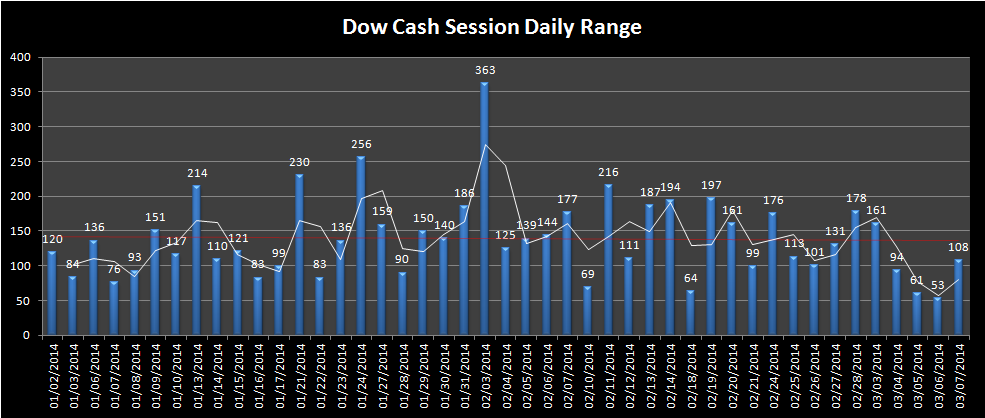

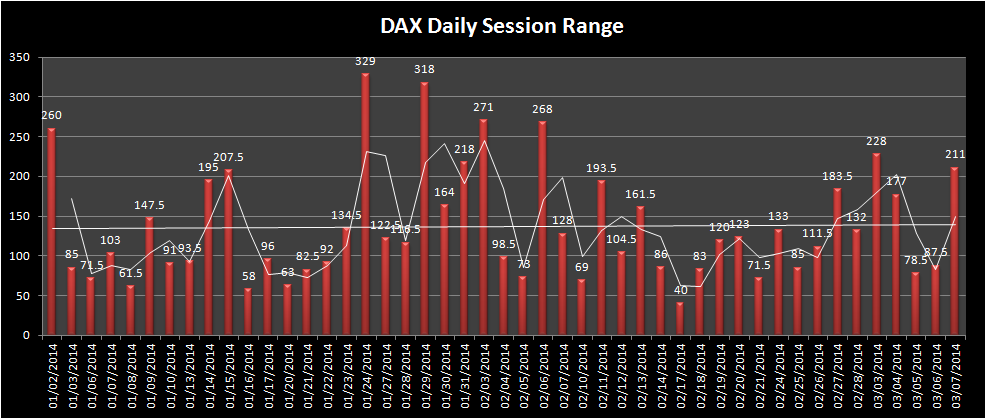

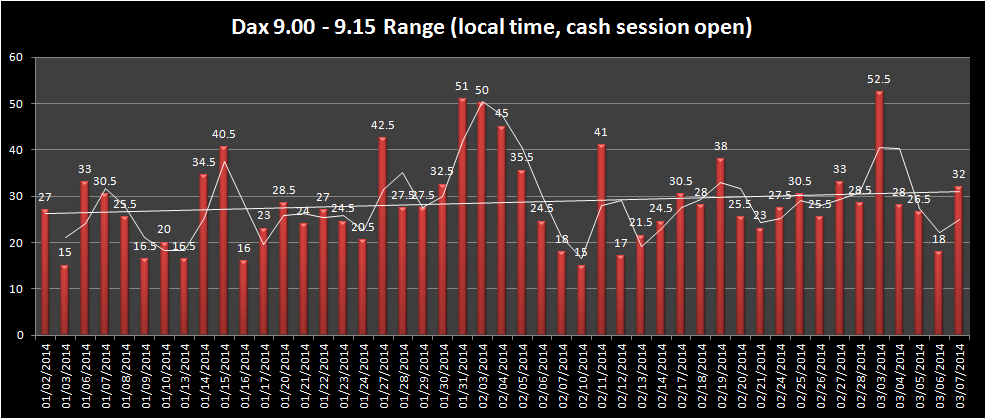

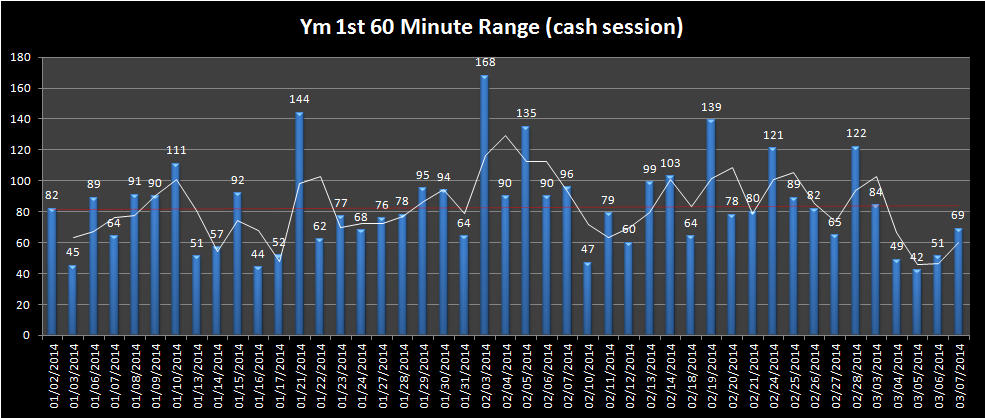

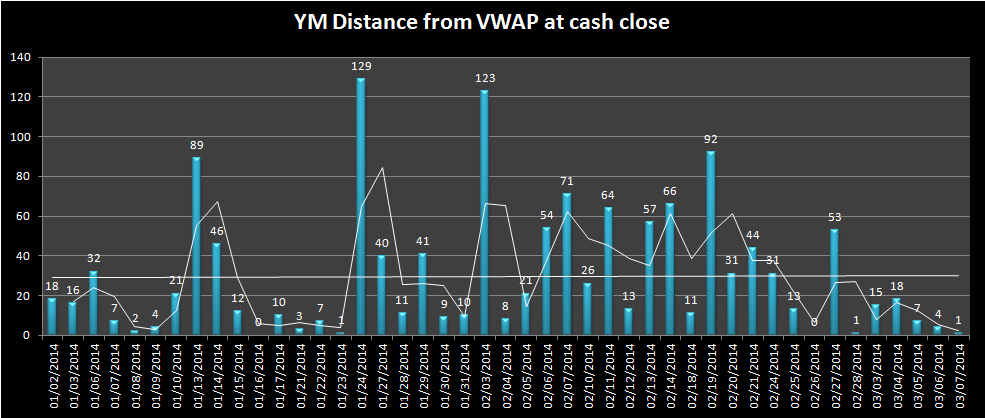

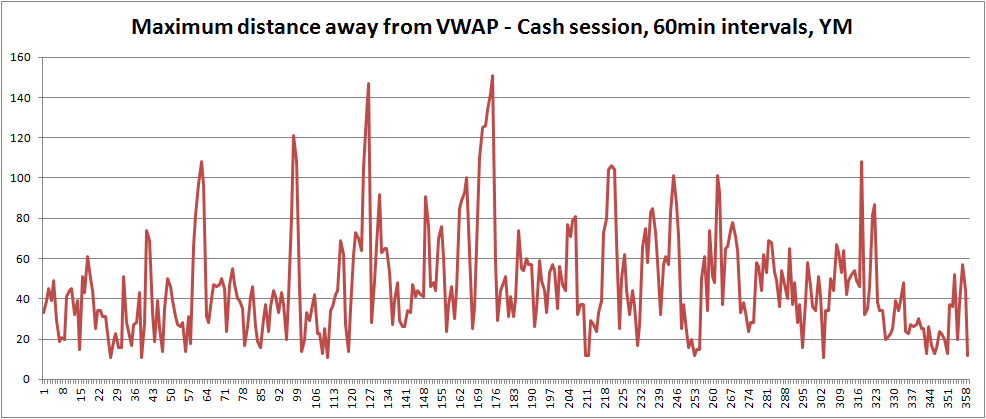

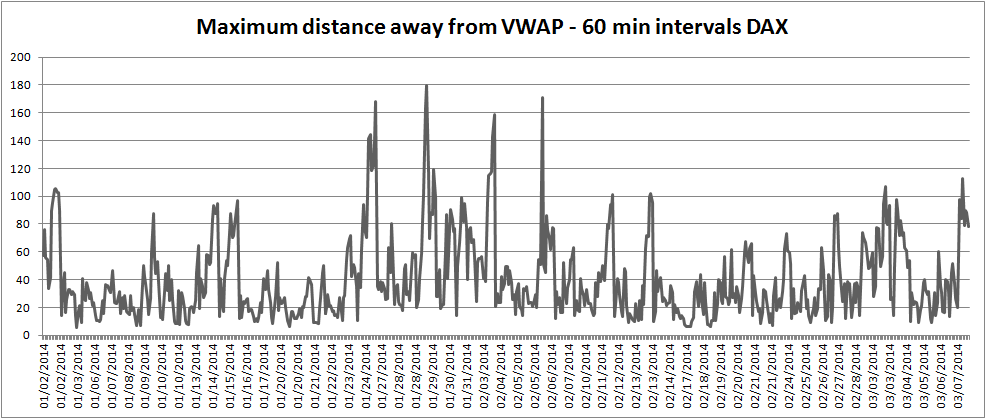

Market Ranges – Data taken from first trading day of 2014 to 7th March 2014, updated each Monday

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]