Fading initial resistance

2 min readYesterdays offered a good opportunity to fade a very strong level on DOW.

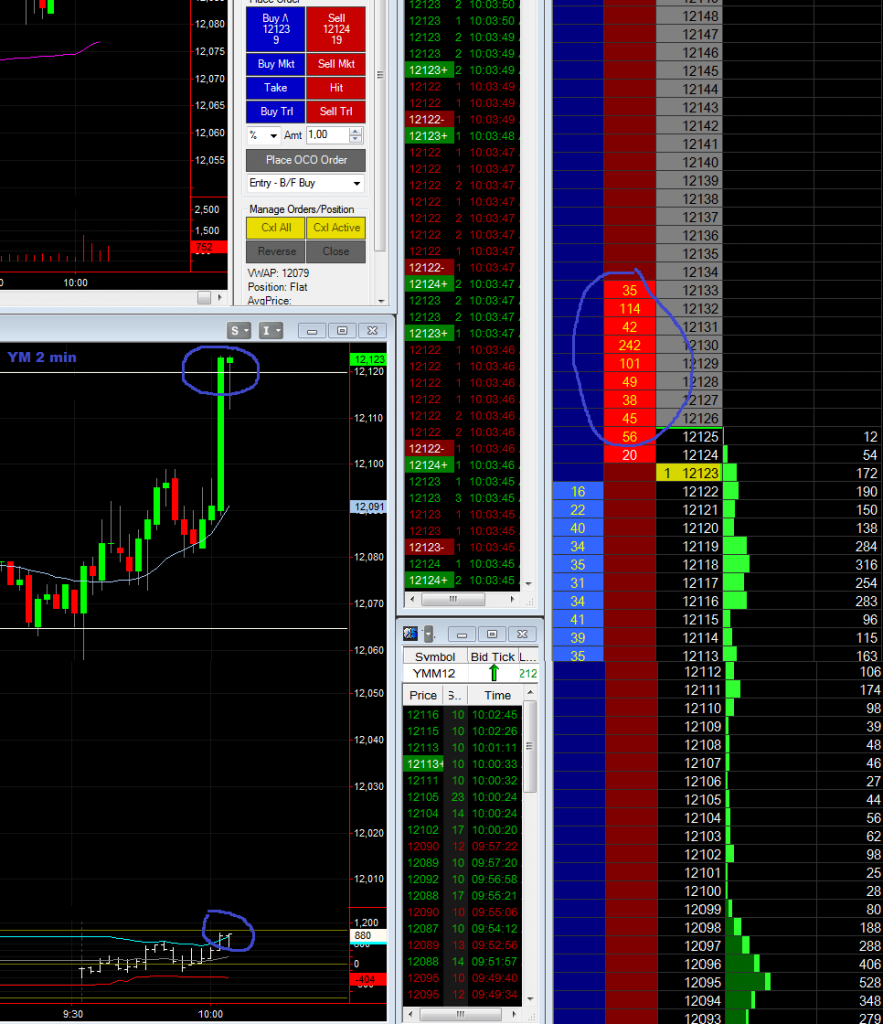

The level of 12120 had been tested several times before and was also a key level if you look at the bigger picture. MA 200 on the daily level.

On monday, it was pretty clear that it wasn´t going to be a follow up on the down trend, when the volume decreased. I compared the first 30 minutes volume with prior days volume. The DAX (German index 30) was also consolidating, so that gave us a clue too.

There were no signs that I could see, that the range was about to break on tuesday, if the volume wasn´t going to add up.

All the preparation and thinkings for tuesdays trading day is in the pdf file Prep 20120605

Ready to fade

If you look at the tape, you see soo much supply between 12129 and 12132 and what I could tell, there wasn´t and hiding buyer on that level.

For me, with such an already tested level and loads of supply that probably won´t move, I would fade it every single time. With NYSE TICK extreme added, you just can´t ask for more.

We also had a natural target at the area around 12065, that also lower the odds I think.

12065, I think is a good target, because there have been so much traded there before, for months and it was also prior days close.

In hindsight, I should left more on the table, for it to reach the final target, but since I´m not a hindsight trader, I covered everything at 12106, when the momentum died a bit.

The most important thing for me with these kind of setups, is that it´s a very low risk, since you can put the stop so tight and sometimes you´re rewarded with a big move. This time it was a small scalp, next time maybe we can leave some on the table for a 100 point move, the risk is the same.

The flush

It always looks good with a good bar and it´s too easy to wait for this confirmation, but you can´t enter when you see it, because then it´s too late. The trade needs to be taken quick for it to be considered low risk.

In hindsight

The 12120 was tested many times more during the day.

Another natural target for this move, if you left some on the table, would have been the *NYSE TICK extreme at 11 am (ET)

* I use to have bollinger band on my TICK and consider it to be extreme when it breaks the outer bands.

/J