Buy Long or Sell Short? – Look for clues

2 min readIt may sound obvious but whether you trade the Dow futures, ES futures, Crude oil or Stocks deciding whether to go long or short should be your primary filter. Only when you have a price bias can you then look for trade setups.

In other words at the very least you should be looking at the price action and deciding which way you will NOT trade.

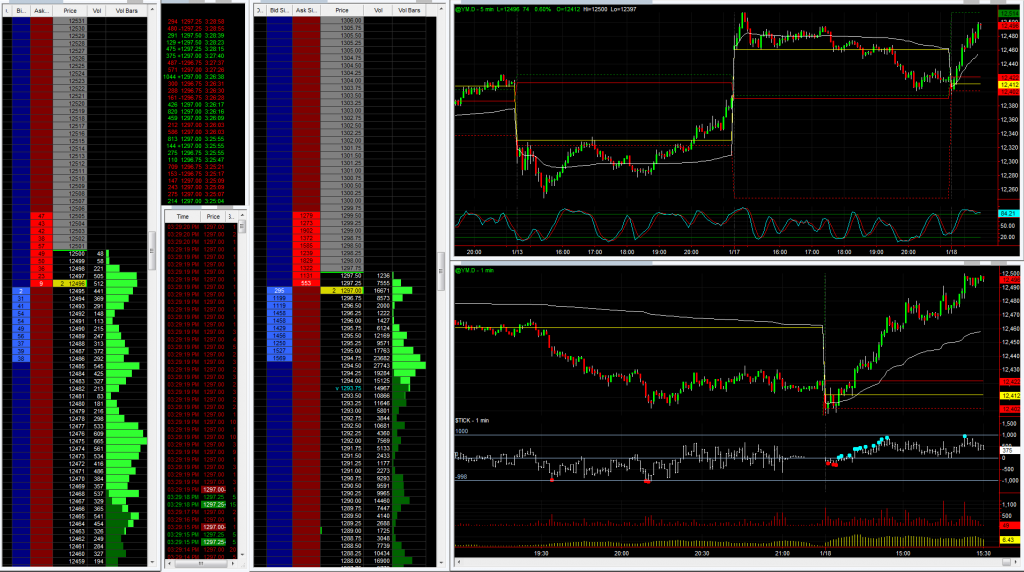

Let me explain with a great market example from today on the DOW mini.

Zoom in on the 1 minute DOW chart

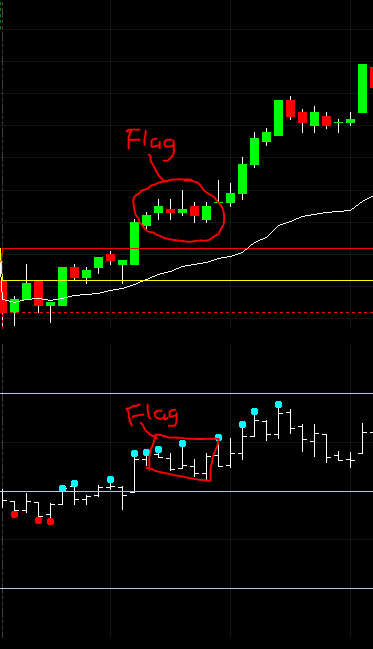

Now what clues did we have to stay clear of any short setups?

1) Active buying at a key level – The dotted red line is yesterdays low, see how in the first few minutes we probed that level several times and found good support both times.

2) $TICK Index – On those low probes towards the prior days low the lowest TICK reading the market could manage was just – 316. What is that telling us? It’s telling us that traders are not panicking on the sell side, they are not hitting stock bids on the NYSE.

3) Overnight Support – The overnight pretty much coincided with the prior days low. Once that’s tagged where is your downside target for any shorts?

4) Natural targets above the price – The gap and 12,500 DOW cash were not far away, these will often act as magnets for price. Especially when targets like the overnight low have already been tagged.

5) Price action – Big clue here for short term day traders and scalpers. See how the price responds to drives higher. We get flagging patterns, indicating a pause in buying that is stalling the price rather than an influx of selling. This is matched on the TICKs, again showing us that traders are not hitting bids on the NYSE. All really useful information to keep us on the long side or at the very least steering clear of short side trades.

Successful daytrading is about reading the clues the market is presenting to you and aligning yourself with the momentum. Once you have the bias then your trading setups and tape reading come into play.

That’s not to say of course that a quick short scalp setup is not possible at some point, every trend comes to an end………BUT it would be a completely different setup! You are then looking for indication that the buying has dried up. An exhaustion through a key level on extreme ticks with a tape stall for example. Trying to grab a few ticks from the overshoot. Or a double top after a deeper pullback.

You would not be shorting pullbacks or flags with that strength staring you in the face!