Tuesday 4th March 2014 – Pre Market Note

2 min read[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_2″ last=”no”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

No significant data due

-

‘Headline risk’ still present

-

Putin backs off

[/fusion_checklist]

[/fusion_builder_column]

[fusion_builder_column type=”1_2″ last=”yes”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Social sentiment turned moderately Bullish

-

Stock traders watchlist: RSX, DNDN, DANG, YNDX

-

Richmond Fed president speaking @ 4.15pm ET

[/fusion_checklist]

[/fusion_builder_column]

“As for the use of military, there is no need for it,” Putin said. “But we have that option.”

Putin’s backed down…..or has he? The markets seem to think so and reports that Russian troops were ordered back to base sent the DAX flying 200pts, YM 185pts and ES 22 handles. Crude and gold have both eased back slightly.

We’ve highlighted the whole headline risk in this market at the moment and that’s very much still the case. Putin had a well received press conference in which his aggression was markedly muted, yet still leaving the door open for military action should it be needed.

It’s worth remembering, patterns, levels and setups can all be negated when market moving headlines are involved. The DAX closed down 3% yesterday and hardly bounced off the lows. Without news headline interference statistics show the odds on that retesting those lows the next day are very high. With headline risk that turns into a 50/50 trade.

That’s worth remembering when taking those intraday setups, different forces are driving things and markets are very fickle.

Good trading,

Morning Audio Briefing @ 9.00AM ET/ 2.00PM GMT

[fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_separator top=”40″ style=”shadow”/]

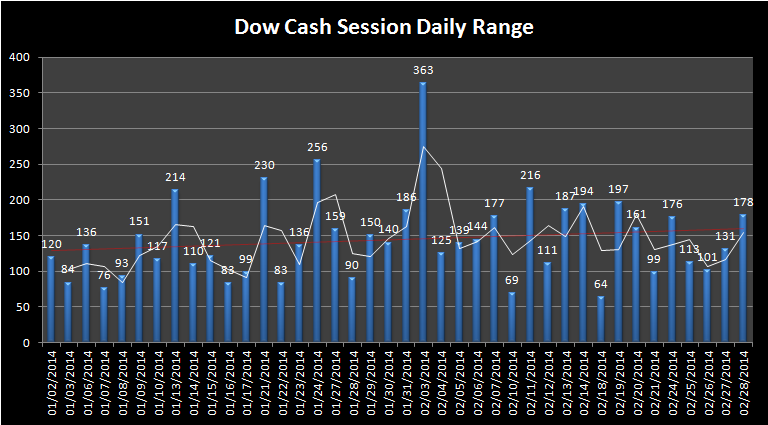

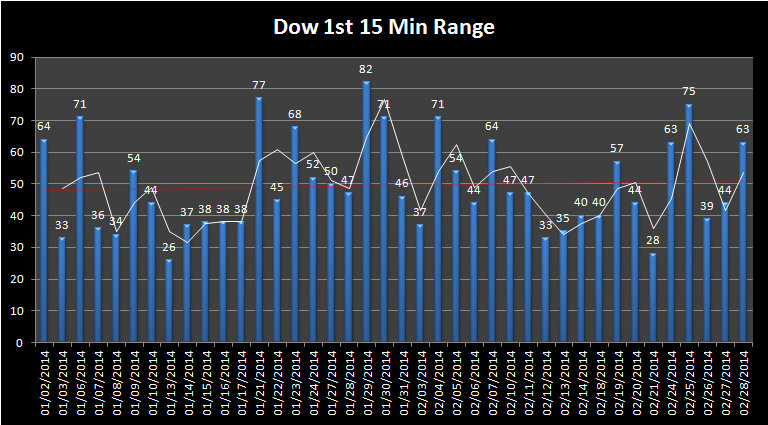

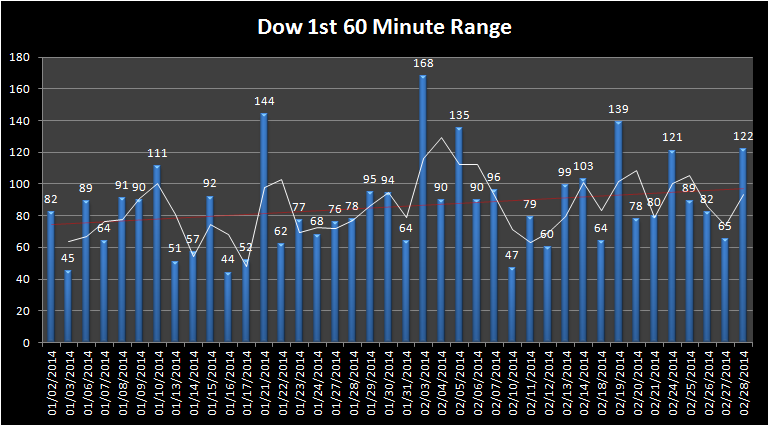

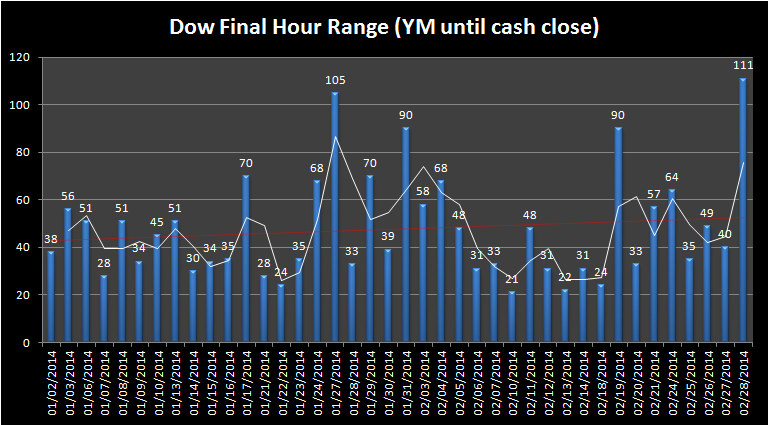

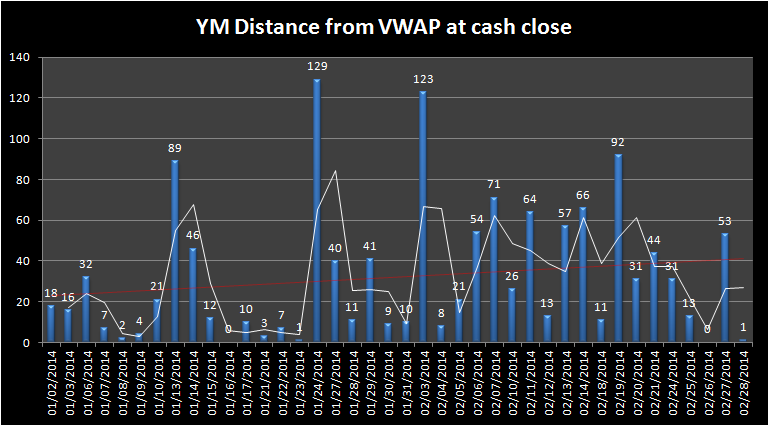

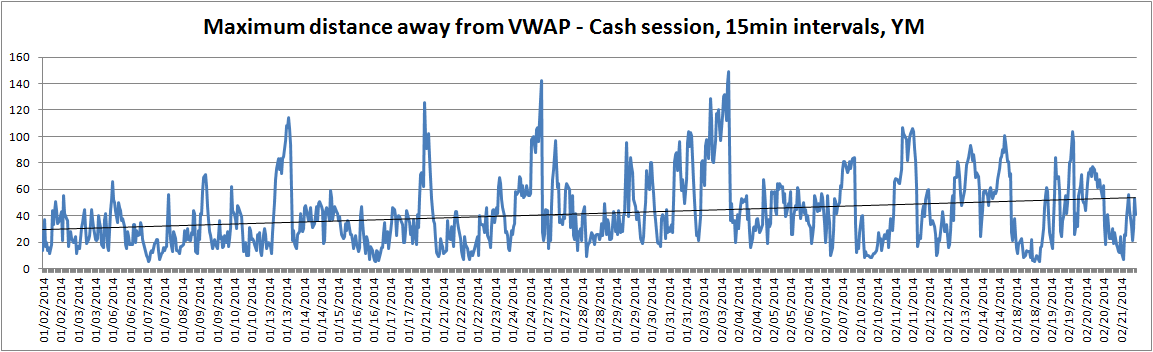

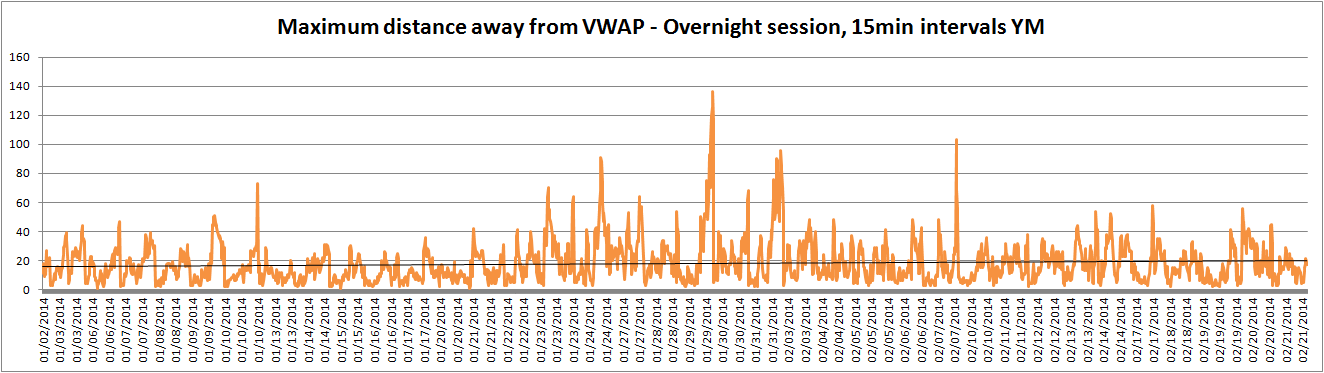

Market Ranges – Data taken from first trading day of 2014 to 2nd March 2014, updated each Monday

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]